Topic 4.1 - Individuals, firms, markets and market failure

Snapshot of the AQA syllabus topic area we’ll be covering in this post.

The Interrelationship between markets: PRICE DETERMINATION IN COMPETITIVE MARKETS

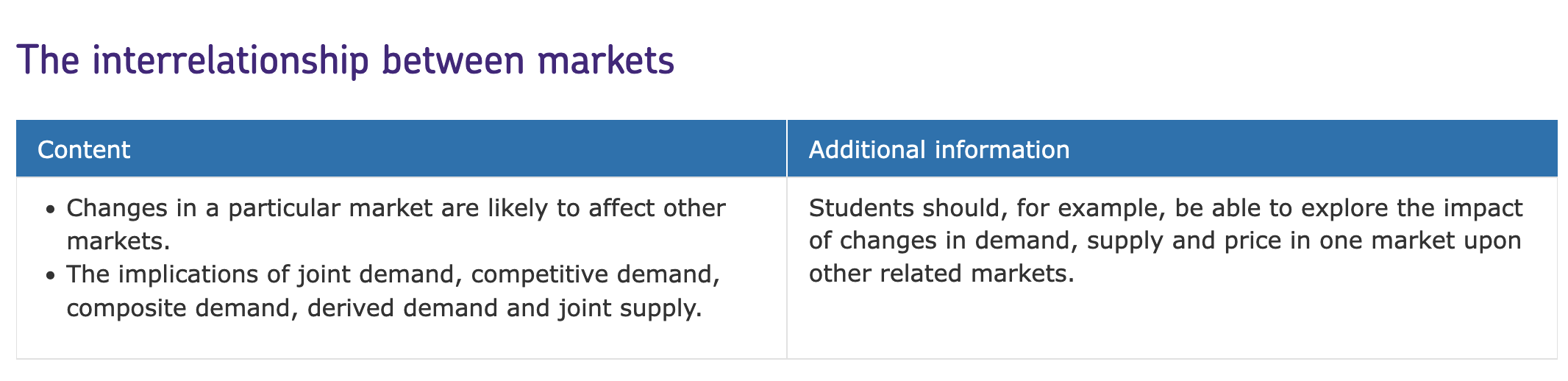

AQA students must understand the following content [taken from the syllabus]

Changes in a particular market are likely to affect other markets.

The implications of joint demand, competitive demand, composite demand, derived demand and joint supply.

INFORMATION YOU NEED TO KNOW

Introduction:

Markets are interrelated and rely on one another in the intricate web of economic activity. A complicated network of connections can be formed when changes in one market have an impact on others. This article examines the connections between markets, emphasising how modifications in one market can affect others. We also explore the consequences of joint supply, competitive supply, composite supply, derived supply, and joint demand, offering insights into their importance in comprehending market dynamics.

The Interplay of Markets

Markets rarely exist in isolation in a connected global economy. Changes in one market can have an effect on related markets and sectors throughout the economy. For instance, a rise in consumer spending on cars can spur demand for businesses in sectors like steel, rubber, and electronics. On the other hand, industries like construction, furniture, and home appliances may be impacted by a downturn in the housing industry.

Policymakers, entrepreneurs, and investors must comprehend these interdependencies. They are better able to plan ahead and negotiate anticipated market consequences, leading to more informed choices and better risk management.

Exploring Market Interdependencies

a) Joint Demand: Some products or services have interdependencies and are needed in conjunction. For instance, since they are frequently used together, petrol and cars both have a joint demand. One product's pricing or availability changes may have an impact on how popular another product becomes. For instance, people may start looking into more fuel-efficient cars or other forms of transportation if petrol costs continue to rise.

b) Competitive Demand: When numerous products are able to fulfil the same consumer wants or needs, competitive demand occurs. Demand for products that compete with one another may be impacted by price adjustments or shifts in consumer preferences. For instance, consumers might choose chicken or other protein sources in place of beef if the price of beef rises.

c) Composite Demand: When a good or resource has numerous uses, composite demand develops. The distribution of a given resource among various sectors or uses determines the demand for it. Corn, for instance, can be used as a food ingredient, to make ethanol, or as animal fodder. Any one of these industries' changes in demand can have an impact on corn's overall demand and price.

d) Derived Demand: Demand for the factors of production are derived from the demand for goods or services - this is known as derived demand. For instance, the need for new housing or infrastructure projects drives the demand for construction employees (labour factor input). The produced demand in different industries might be impacted by changes in investment levels or economic conditions.

e) Joint Supply: When a single good or resource may be utilised to create a number of different products or services, this is known as joint supply. For instance, the creation of petrol, diesel, and other petroleum products uses crude oil as a key input. The supply and prices of a variety of downstream goods can be impacted by changes in the availability or price of crude oil.

Conclusion:

A key component of the modern economic system is the interaction of markets. Changes in one market can have an impact on other markets through joint supply, competitive supply, composite supply, derived demand, and composite demand. To make intelligent decisions and successfully react to market swings, regulators, firms, and investors must be aware of these interdependencies.

Stakeholders can foresee the effects of changes in demand, prices, or resource availability by understanding the dynamics of market interrelationships. Better risk management, strategy planning, and resource allocation across interconnected markets are made possible by this knowledge. Adopting this comprehensive viewpoint promotes a deeper comprehension of market dynamics and enables more robust and flexible economic structures.