Topic 4.1 - Individuals, firms, markets and market failure

Snapshot of the AQA syllabus topic area we’ll be covering in this post.

PRICE DISCRIMINATION: Perfect competition, imperfectly competitive markets and monopoly

AQA students must understand the following content [taken from the syllabus]

The conditions necessary for price discrimination.

The advantages and disadvantages of price discrimination.

INFORMATION YOU NEED TO KNOW

[NOTE: supporting diagrams and questions at the end]

Introduction: Price Discrimination

Price discrimination is the practice of charging various customers or groups of customers different rates for the same good or service. It happens when a manufacturer or seller has the ability to divide the market into segments based on the characteristics of their target market, such as their willingness to pay, where they are located, how old they are, or how much money they have to spend. By capturing the consumer surplus—the difference between what customers are willing to pay and the actual price they pay—price discrimination aims to maximise profits.

Price discrimination can occur on a first-degree, second-degree, or third-degree basis, among other levels.

Price discrimination can be advantageous for businesses since it enables them to increase revenue by getting more value from different customer types. However, it can also raise questions about fairness and have unfavourable effects on consumer welfare, especially if it disadvantages some consumer groups or lessens market competition. To ensure that price discrimination practices do not eventually lead to anticompetitive behaviour or negatively impact consumers, economists and policymakers carefully examine these practices.

Definition of Price Discrimination: when firms charge different prices to different customers for the same product.

Assumptions of Price Discrimination:

First must have price making power, therefore barriers to entry likely to exist

Firms should be able to identify and separate different groups of customers by understanding their PEDs.

No seepage – when customers can buy at a lower price from the firm and re-sell it themselves

Examples of Price Discrimination:

Train tickets: same train service at different time of the day attracts easily over 3x the price (rush hour)

Student discounts: e.g. clothes shopping or McDonald’s. 10% discount on exactly the same clothes. Free cheeseburger with a meal if an NUS card is shown

Why Firms Price Discriminate: Price discrimination allows the seller to charge different prices for the same product to different consumers.

Therefore, it allows the seller to charge higher prices to people who place a higher value on their products, and at the same time, charge lower prices for those who are more sensitive to price.

In the example of a train ticket to London, somebody commuting to London is likely to be travelling out of necessity in order to get to work. Knowing this, train companies increase the price for those who are travelling to work at peak times of the day.

People travelling for leisure are more likely to be sensitive to price, so train fares are reduced at off-peak times of the day

The Impact of Price Discrimination on Surplus: Surplus is a measure of welfare. Consumer surplus is a measure of consumer welfare and producer surplus is a measure of producer welfare.

Consumer surplus: defined as the difference between the current market price and the maximum price consumers are willing to pay

Producer surplus: defined as the difference between the market price and the minimum price the producer is able to sell at.

When prices are increased by the seller, consumer surplus falls and producer surplus rises.

There is a transfer of surplus from the consumer to the producer.

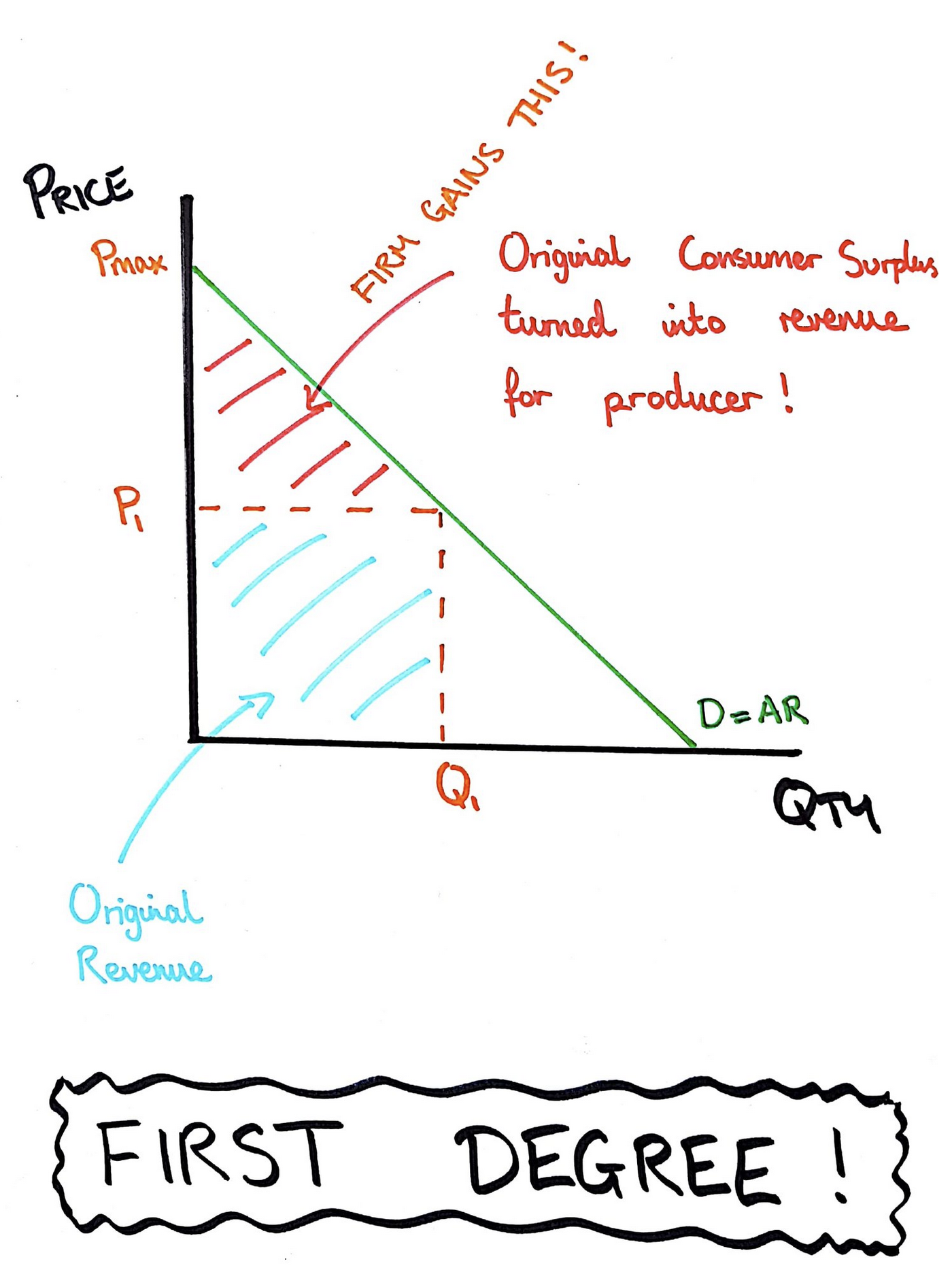

First Degree Price Discrimination: This is when the firm knows the maximum price that each individual consumer can pay. The firm is able to charge a different price to each consumer, thereby maximising its potential to extract profit/revenue from the market.

There is no consumer surplus in the market, because everybody in the market is paying their maximum possible price.

In reality, this is pretty much impossible because the seller would need perfect information to achieve this.

Gathering information is very costly, which would eat into the firm’s profits – therefore, it is unlikely a firm will ever benefit from first degree price discrimination.

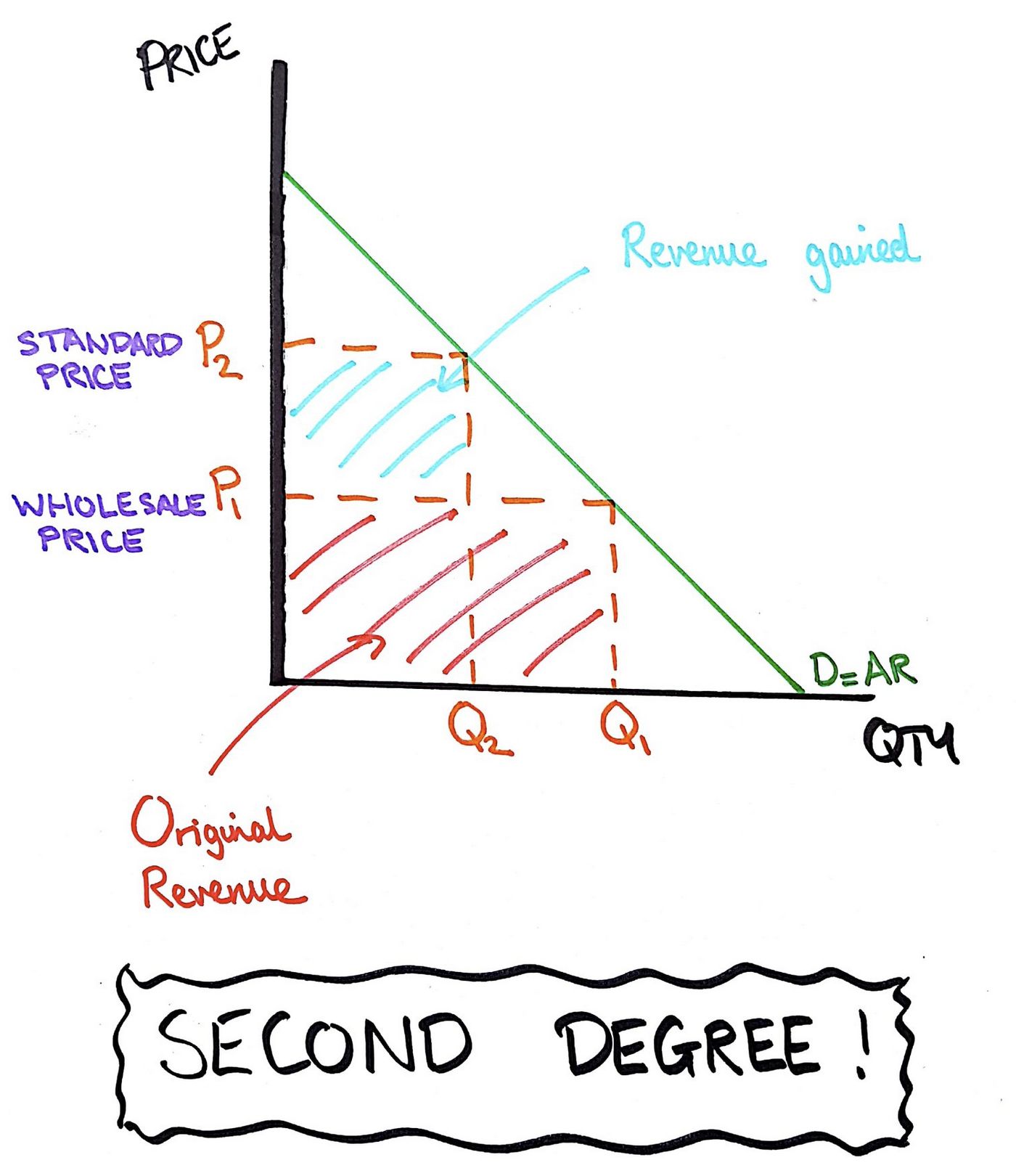

Second Degree Price Discrimination:

This is often occurs in wholesale markets. Discounts are provided to those who buy large quantities of a good. The more you buy, the less you pay per unit.

The price charged is based on the quantity you buy. This encourages larger orders to be made.

Those who do not want to bulk buy, will instead pay the market price.

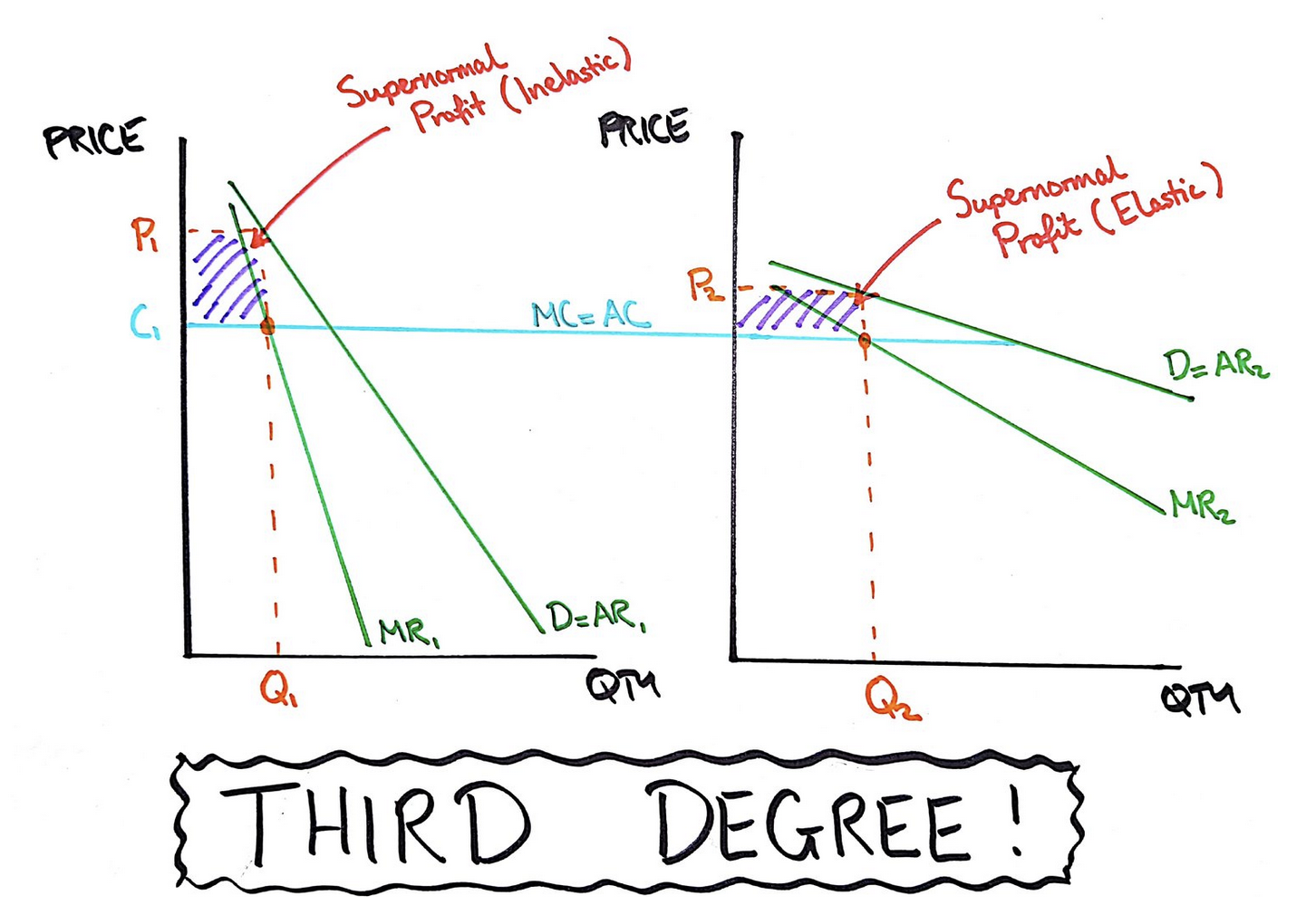

Third Degree Price Discrimination:

When a firm charges different prices for the same product across different segments of the market. The firm categorises customers into different categories such as:

Peak vs Off-peak travellers

Children vs Adult

Adult vs Pensioner

Private Sector vs Government workers

Armed Forces

Customer Geography

Firms raise prices for groups with lower elasticity of demand. Firms lower prices for groups with higher elasticity of demand.

Profit maximisation occurs at the point MC=MR (like always).

The firm is better able to profit maximise because they produce more revenue from each target group than without any discrimination.

Advantages of Price Discrimination to Society:

Increased consumer surplus: Price discrimination can make it possible for customers with lesser purchasing power to receive goods or services at a cheaper cost, boosting their consumer surplus and enhancing their welfare.

Redistrubtion of income: Price discrimination in some cases means higher income groups pay higher prices for products than lower income groups. This means price discrimination has redistributive properties and therefore may benefit income inequality.

Improved market efficiency: Price discrimination enables businesses to better match prices with consumers' willingness to pay, which improves market efficiency by more effectively allocating resources.

Increase income for businesses: By capturing distinct market niches at various price points and allowing for increased profitability and potential investment in R&D, price discrimination can assist businesses in generating additional income. This can result in better dynamic efficiency.

Disadvantages of Price Discrimination to Society:

Reduced consumer welfare: Price discrimination can cause certain customers to pay more for the same goods than others, lowering overall consumer welfare and sometimes resulting in imbalances.

Potential exclusion: Price discrimination can prevent some customer groups from accessing certain goods or services because they cannot afford the higher prices imposed for those segments.

Inefficiency and market distortion: Because businesses concentrate on market segmentation and profit maximisation rather than manufacturing goods efficiently, price discrimination may lead to market distortions. A loss of total economic welfare and a misallocation of resources may result from this.

Diminished competition: Price discrimination can increase the market dominance of established businesses, making it harder for newcomers to compete and lessening total market competition.

SUPPORTING DIAGRAMS

first degree price discrimination - the firm has perfect knowledge about every consumer - so firms charge each and every consumer according to their maximum value of the product - this allows firms to extract every last bit of consumer surplus in the market - the result is even greater profits for the producer

second degree price discrimination - the seller charges multiple prices according to the quantity you buy - for example buying a product wholesale will reduce its price compare to buying 1 unit

third degree price discrimination - firms price according to the elasticity of demand among different groups of people - on the left we have the group with inelastic demand - these people are not sensitive to price - this could be people taking the train to work, for example - on the right we have the group of people who are demand elastic - these people are sensitive to price, and the firm generates more income if the price in this segment is decreased - this could mean lower prices for leisure travellers on the train

SUPPORTING QUESTION

Question:

Give 3 reasons why a monopoly firm would want to price discriminate:

Answer:

A monopoly firm would benefit from price discrimination tactics for several reasons:

Increased Revenues and Profits: Due to price discrimination, the monopoly firm is able to charge higher prices to clients with higher willingness-to-pay. The company can extract more income and boost its overall profitability by segmenting the market and setting different rates for various groups.

Higher Market Share: By using price discrimination, the company can target specific market segments and modify its pricing approach to increase sales in each one. As a result, the company is able to enhance its market power and capture a bigger share of the market. Higher market share might be beneficial to the firm’s long-term survival

Creation of Barriers to Entry: Price discrimination can serve as a barrier to entry for potential competitors. Because of a lower average cost of production, a monopoly firm may be able to reduce prices for certain groups of customers and stay in business. For example, a monopoly airline might sell cost price plane tickets at off-peak times of the year and still stay in business. This pricing tactic makes it more difficult for new entrants to survive, thus reducing the monopoly’s long-term competition.

![AQA ECONOMICS A-LEVEL SPECIFICATION SYLLABUS TOPIC 4.1 [PRICE DISCRIMINATION]](https://images.squarespace-cdn.com/content/v1/55b690f2e4b076db679cd340/a8448d5d-f446-482c-a2bf-740b330abfcb/AQA+ECONOMICS+A-LEVEL+SPECIFICATION+SYLLABUS+TOPIC+4.1+%5BPRICE+DISCRIMINATION%5D)